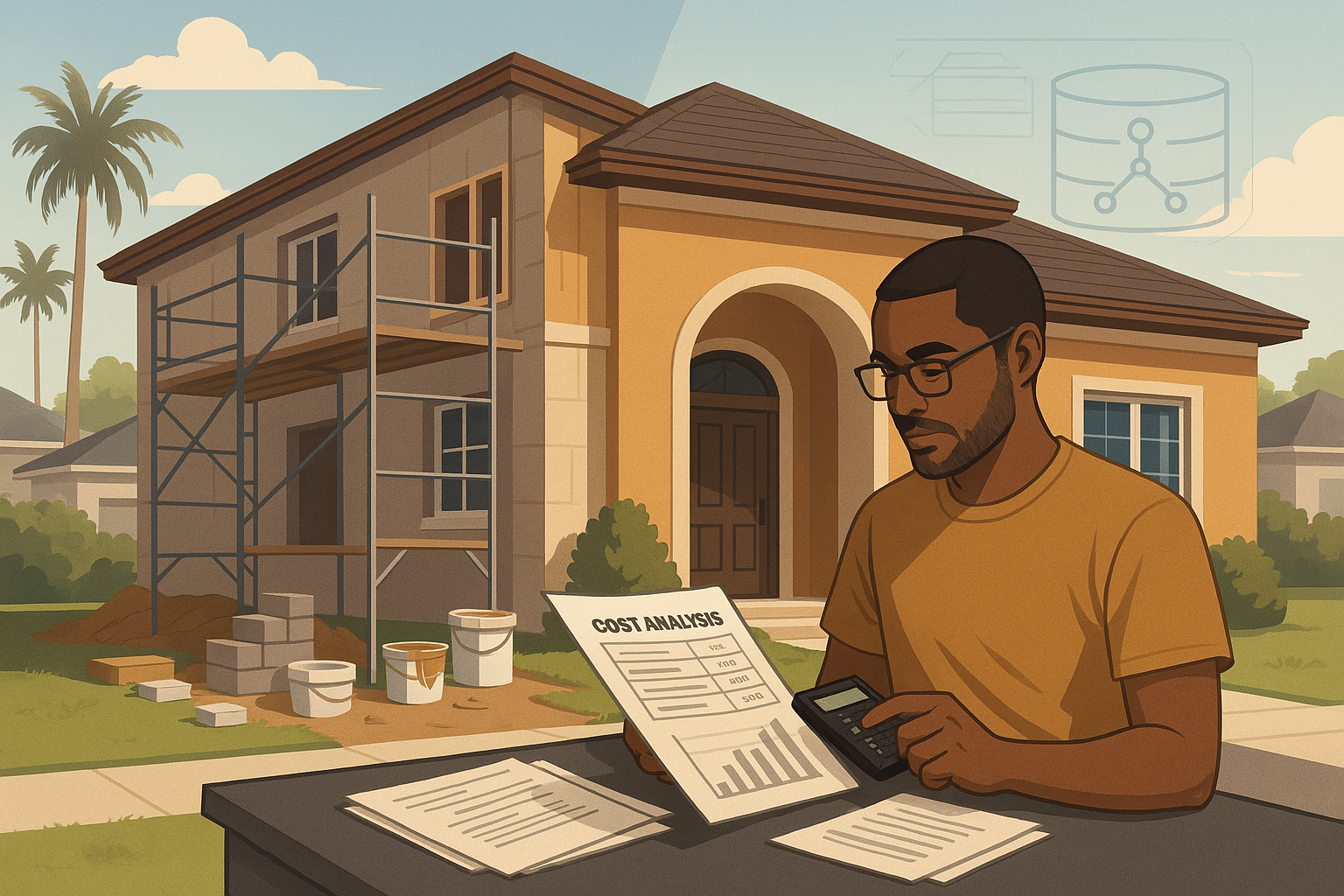

How to Finance Your Remodel Without Hurting Your Credit

Introduction

Dreaming of a kitchen remodel, bathroom upgrade, or a brand-new outdoor living space—but worried about the financial strain? You’re not alone. Many homeowners in Plantation, Florida are ready to renovate, but unsure how to fund their project without negatively affecting their credit. The good news? With the right strategy, you can finance your remodel smartly, stay within your means, and even improve your home’s value in the process.

At Fresh Remodel, we work with homeowners every day who are transforming their spaces without compromising their financial future. Here’s how you can do the same.

1. Know Your Credit Score Before You Start

Before you explore financing options, check your current credit score and review your credit report. This will help you understand your eligibility for certain loans and reveal any issues that may need correcting before applying.

You can access your credit report for free at AnnualCreditReport.com, and many banks and credit cards offer free score tracking tools. A higher score gives you access to better interest rates, which means lower monthly payments and less long-term debt—a win when funding your remodel.

2. Consider a Home Equity Loan or HELOC

One of the most popular ways to finance renovations in Plantation is by tapping into home equity. With home values rising steadily across Broward County, many homeowners have built up equity they can borrow against. There are two common options:

Home Equity Loan: A lump sum with a fixed interest rate and monthly payment.

Home Equity Line of Credit (HELOC): A revolving line you draw from as needed, with variable rates.

Both options typically offer lower interest than personal loans or credit cards and don’t directly harm your credit if used responsibly. Just make sure you can comfortably repay, since your home is used as collateral.

3. Look Into FHA 203(k) Loans

If your remodel is part of a larger home improvement project—especially for fixer-uppers—an FHA 203(k) loan may be worth considering. These government-backed loans roll home purchase and renovation costs into one mortgage, and may be easier to qualify for if your credit isn’t perfect.

In Plantation, this can be a great option for buyers or current homeowners renovating an older property while still locking in a manageable monthly payment.

4. Use a Personal Loan Strategically

A personal loan is an unsecured option—meaning no collateral is required—and can be a quick solution for smaller to mid-sized projects like bathroom upgrades or patio makeovers. These loans are best for homeowners with strong credit scores, since interest rates can be higher than equity-based options.

To avoid hurting your credit:

Shop around and compare rates (use soft inquiries when possible).

Borrow only what you need—don’t overextend.

Set up automatic payments to avoid missed due dates, which can ding your score.

5. Explore In-House Financing with Contractors

Some licensed contractors and remodeling companies—including Fresh Remodel—offer in-house or partnered financing programs with competitive terms. These programs may offer low or no interest promotional periods, especially for well-qualified buyers.

Working with a company that understands the local market (like ours here in Plantation) also ensures the financing is tied to realistic project scopes, timelines, and your actual renovation goals.

6. Avoid High-Interest Credit Cards Unless Used Tactically

Credit cards should be a last resort for financing a remodel—but they can work for very small updates, especially if you’re using a 0% APR promotional offer and have a clear plan to repay within that period.

Otherwise, high interest rates and high balances can quickly harm your credit utilization ratio, which can lower your score. If you do use a credit card, try to keep the balance below 30% of your credit limit, and pay more than the minimum each month.

7. Budget Wisely and Avoid Scope Creep

Financing smartly also means staying on budget. One of the fastest ways to harm your financial health is by taking on more work than you can afford. At Fresh Remodel, we provide transparent project estimates, phased construction options, and clear payment schedules so you’re never caught off guard.

When you’re remodeling in Plantation, where outdoor upgrades, energy-efficient additions, and storm-ready features are popular, we help prioritize what brings value to your home—without overwhelming your wallet.

Conclusion & Call to Action

You don’t have to put your remodel dreams on hold—or risk your financial stability. With the right financing strategy, a realistic budget, and a trustworthy contractor, you can upgrade your home in Plantation, FL without hurting your credit or peace of mind.

At Fresh Remodel, we guide you through every step—from budgeting and planning to financing and flawless execution. Whether you’re looking to modernize your kitchen, create a stunning outdoor space, or add hurricane protection, we’re here to make it possible—and affordable.

Located in: Plantation Promenade

Address: 10089 Cleary Blvd, Plantation, FL 33324

Phone: (954) 933-4510

👉 Ready to explore remodel financing options without the stress? Contact Fresh Remodel today for a free consultation and let’s build your dream home—one smart step at a time.

Leave a Reply